Princeton decentralised finance lecture

Why decentralised finance was the first use case for smart contracts

Recently, I was invited by JP Singh (my colleague at Trust Machines which he co-founded) to give a lecture at Princeton University. JP leads the new Bitcoin and crypto centre there. Since the students seemed quite engaged, I thought to turn this into a post.

We talked about Decentralised Finance (DeFi) and why it became the first use case that enables sustainably profitable smart contract applications. Today, about $50b worth of digital assets is put to use in DeFi applications. Anyone can permissionlessly interact with this financial ecosystem - you only need a crypto address. The students I spoke with had this context and wanted to learn more.

In the lecture we talked about why DeFi is the first logical use case for smart contracts, DeFi as automation for finance, and upcoming challenges for DeFi adoption. Let’s get into it.

Finance is the first blockchain application

It makes a lot of sense that DeFi apps were the first blockchain applications that proved to be sustainable.

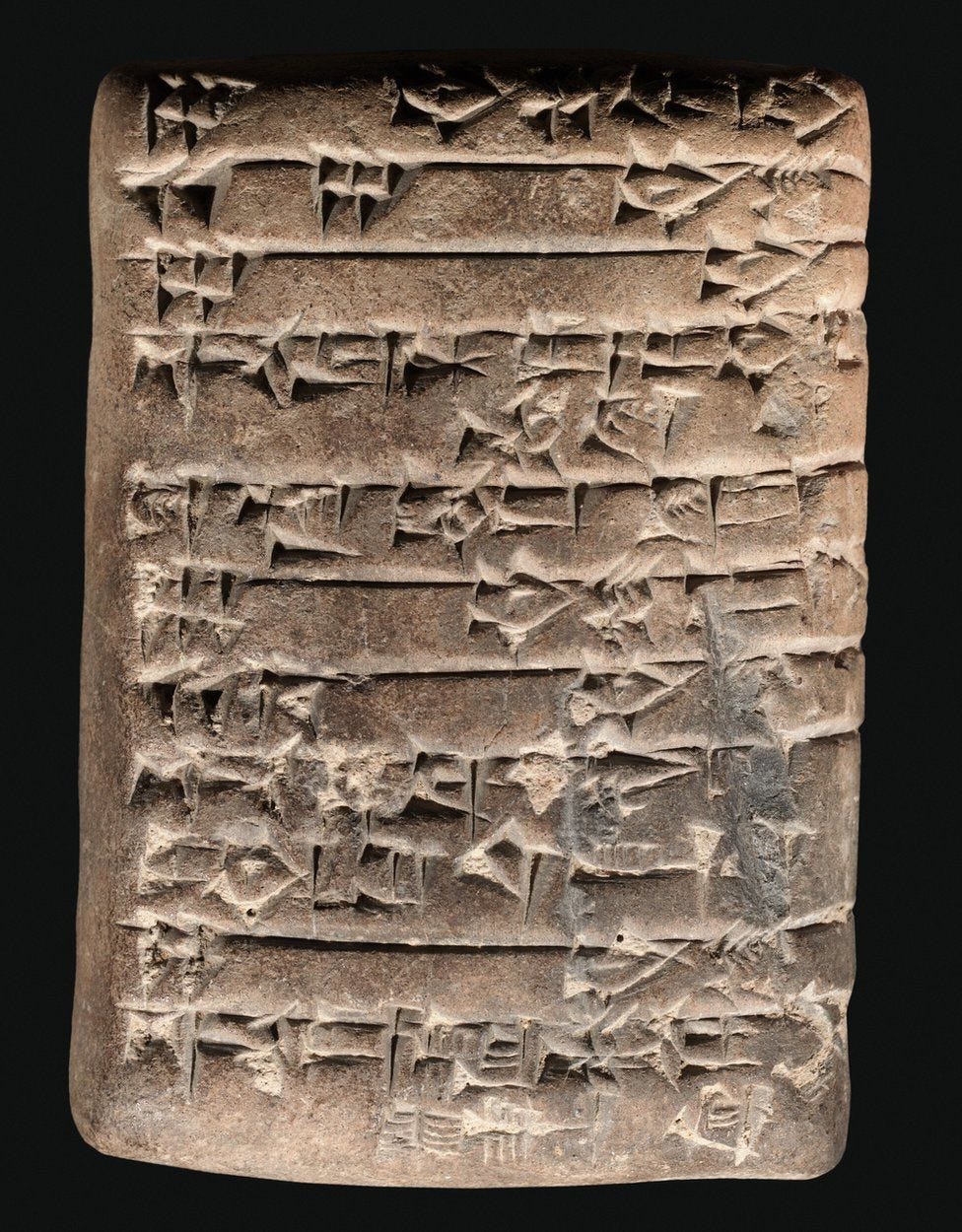

When we look at history, finance precedes money. More than a thousand years before the first coins appear, Sumerian traders kept track of credit on clay tablets. These Sumerians didn’t use money to keep track of value in society, but some kind of system of ledgers that record debts.

These clay tablets are guaranteed by state enforced consensus. Finance is thereby also the first use case for contracts. After blockchains gave birth to the world’s first programmatic contracts (also known as smart contracts), it makes a lot of sense that decentralised finance became the first use case for smart contracts.

Finance is one of the most engaging things on earth, which drives users to DeFi applications. Apps need users to make money and users need to be engaged. In the early days of the internet, two types of applications took off that engaged many people to get internet connections: gambling and adult content. As blockchains aren’t very good at storing large amounts of data, gambling is the best application to pull in the first mainstream users. There’s only a very fine line between gambling and finance. It’s no coincidence that my friends at high frequency trading firms are also some of the best poker players I’ve ever met. Finance drives engagement, engagement drives users, and users drive sustainable application development.

DeFi is automation for finance

The best mental modal to understand DeFi is: automation for finance.

Pre-blockchain finance technology applications (fintech) use the same financial rails as the legacy financial systems (banks, wire transfers, etc). In other words, Fintech just changed the user interface for parts of the financial system without touching the infrastructure. At the same time, computers cannot interact directly with this legacy financial system. Everything relies on permission. Transactions only exist from one legal person to another.

As blockchains created digital property, DeFi allows users to manage this digital property over time (hedging, trading, borrowing, etc). Because blockchains are native to the internet, computer programs can now directly interact with this new financial system without having to go through legal entities first. In a world where software is one of the only sectors of the economy that produces growth, this is a huge development. Many people say that DeFi is about ‘banking the unbanked’. While I don’t doubt that DeFi will have an impact on people in developing countries, the real ‘unbanked’ in our digital societies are computer programs. Blockchains enabled computer programs to own assets for the first time. DeFi enables computer programs to manage these assets over time without relying on humans - in other words, automation for finance.

The word ‘decentralised finance’ feels like a misnomer to me, since it implies some kind of anarchist financial space without centralised authority. However, DeFi has the clearest rules of any financial system that has ever been created: code. Are you worried the DeFi app you use might freeze withdrawals? Just check the code. Are you worried that your DeFi app suffered heavy losses and might no longer be able to cover your position? Just check the blockchain. If anything, a much better name for DeFi would be ‘the internet financial system’.

Challenges for the internet financial system

The two main challenges for this new internet financial system are capital inefficiencies and regulatory challenges.

Most DeFi protocols are highly capital inefficient, relying on users to overcollateralise their positions and automatic liquidations. While these protocols have provided huge value in showing the world how to build blockchain enabled finance, we need credit applications and infrastructure to really enable the decentralised economy to grow. Bitcoin is the largest crypto asset but it’s still barely used for yield generation in DeFi protocols. DeFi applications primary source of yield generation is overcollateralised lending and Bitcoin is rarely borrowed overcollateralised (all other crypto assets are more volatile and hence not suitable as collateral for borrowing BTC). These fundamental problems with the current DeFi protocols are some of the reasons why I started building Zest Protocol.

The regulatory status of DeFi also needs to be resolved for it to break into the mainstream. When assets are pooled in smart contracts and lent out programmatically by the contract, it seems to be legally unclear whether there are any lenders in this transaction (there only seem to be liquidity providers to the smart contracts and borrowers). This is a big head scratcher for lawyers and regulators. How could there be a loan without a legal person that’s the lender? In the end, the DeFi protocol functions as the lender and acts programmatically and permissionlessly (there’s no one who can pull the plug). Most regulators are kicking the can down the road on DeFi and this uncertainty slows adoption (but also creates opportunities for those willing to build).

After this high level overview of crypto finance, we went in depth with some hands-on examples of how popular DeFi protocols like Uniswap, Aave, and MakerDAO work - including more specific topics such as MEV and Flash loans - followed by a great Q&A session.

All in all, I can’t help but feel that Bitcoin and crypto have really gone a long way since I first got involved. Only a few years ago, financial crypto applications were little known experiments launched from people’s bedrooms. Today, they are a core part of the curriculum of Computer Science students at top universities. I’m very excited for what the future will bring!